IAI Unmanned systems push for international growth

Like all of the Middle Eastern nation’s defence companies, Israel Aerospace Industries (IAI) is in a delicate predicament: it cannot reveal much of its clientele, and Israeli politics – internal and external – put major limitations on what it can sell, and where.

Many of the governments buying IAI equipment, including major customers buying top-shelf systems, do not speak publicly about their purchases, and IAI does not disclose them.

“I can tell you no-one bought from Israel because they like us, or they love us,” says Tommy Silberring, general manager of IAI’s Malat division, which manufactures its UAVs. “They buy from us because we have a capability that is maybe better in price, or because we have the flexibility to enable that country to integrate their own systems.”

IAI is not only the country’s largest defence company, but also one of the major drivers of high technology in a place famous for its technological prowess. Its 17,000 employees are divided into six divisions, three concerned with military projects and three with civil work. IAI’s backlog is valued at $10.6 billion and in January the manufacturer disclosed its largest order ever, valued at $1.6 billion and covering a range of systems including Heron 1 UAVs, Harop stand-off munitions and Green Pine radars.

Among the civil divisions, Bedek is pre-eminent. Based at IAI’s facility besides Ben Gurion airport in Tel Aviv, Bedek is mainly concerned with passenger-to-cargo conversions of the Boeing 737, 747 and 767, a roster to which additions are under consideration. Maintenance, repair and operations work is also a major contributor to IAI’s bottom line.

SPANNING SECTORS

IAI also produces G150, G200 and G280 midsize business jets for Gulfstream. The aircraft are built in Tel Aviv and flown to the USA for interior outfitting. The G280 is the latest offering. After a four-year development programme the aircraft has earned approval from the Israeli civil aviation authority, but is not yet certified with the US Federal Aviation Administration or European Aviation Safety Agency. Despite what is widely acknowledged as expectation-exceeding performance, the depressed market for new midsize business jets and correspondingly small order book means it may be some time before IAI comes anywhere near recouping its development costs.

The Israeli Defence Force is in the middle of a highly competitive $1 billion contest for an advanced trainer aircraft to replace its aged Douglas A-4 Skyhawks. As whichever trainer is eventually selected will be operated by IAI, the company stands to gain either way. The field has narrowed to two competitors: Italy’s Alenia Aermacchi M346 and South Korea’s KAI T-50. The governments of both nations are long-time customers for various IAI products, and both nations have threatened to look elsewhere for equipment should their products not be selected. Preliminary indications are that Italy has the favoured product.

Special-mission aircraft – regular aircraft packed full of specialised electronics – have been particularly lucrative for IAI. Its offerings include heavily modified Gulfstream Vs for airborne early warning (AEW), signals intelligence and synthetic aperture radar. Several deals are potentially forthcoming, and Italy has reportedly committed to buy two of the AEW aircraft if Aermacchi wins its trainer bid.

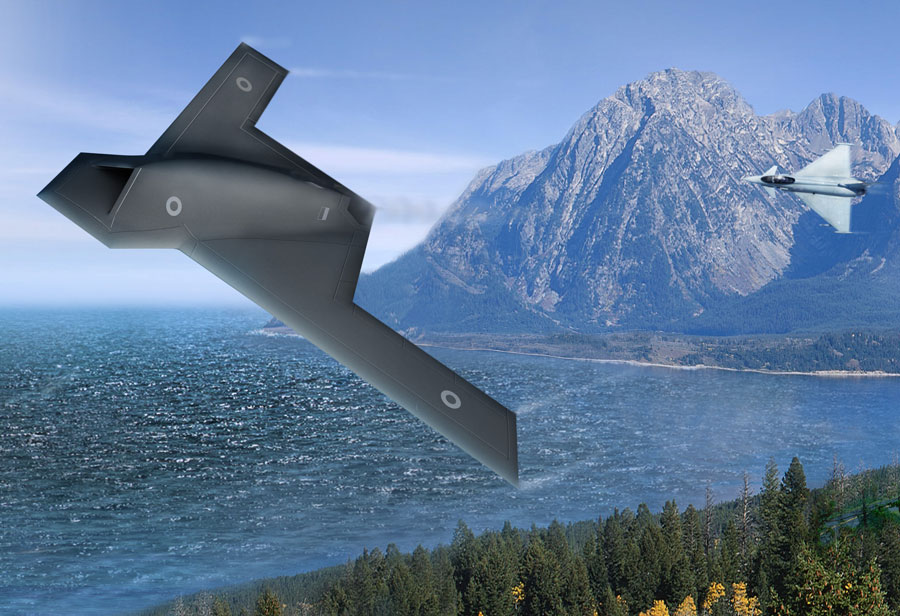

IAI’s bread and butter is UAVs for export. Widely considered to be among the inventors of the modern UAV, IAI remains on the cutting edge of international markets in that area. It offers a more diverse array of UAVs than any other manufacturer in Israel, ranging from a tiny hand-launched aircraft, the Mosquito, to the Heron TP, a large medium-altitude long-endurance (MALE) aircraft capable of staying in the air for two days.

In keeping with the tradition of Israeli defence companies, almost 80% of its sales are made abroad. India, one of the world’s largest and fastest-growing defence markets, is a particularly loyal customer of IAI’s. India operates around 50 Heron UAVs with IAI-developed radar and optical payloads, plus a number of IAI-modified special-mission aircraft. “India is one of our biggest markets,” confirms Silberring.

CROWDED ARENA

Other countries operating the Heron include Australia, France, Germany and Brazil. Most operators have only a handful of aircraft on a lease basis, many for operations over Afghanistan, but IAI is angling for purchases. France has selected a version of the aircraft co-produced with Dassault, called the Harfang, for purchase, despite blistering criticism from the French senate. In each of these contests the aircraft faces competition from the General Atomics Aeronautical Systems Predator B, the only other large MALE aircraft available on the international market. However, the arena is likely to get more crowded as other companies – particularly Northrop Grumman and BAE Systems – bring their own offerings to the table. But for the meantime IAI has a lock on non-NATO countries.

IAI’s electronics division, Elta, is the fourth-largest radar manufacturer in the world, providing systems for both IAI’s products and those of others. Ironically, despite it being among the early adaptors of solid-state electronics, Elta’s most sought-after and profitable services are for older technology. Many of IAI’s customers are simply not in the market for cutting-edge technology.

“We thought that we would phase out of [TWT, transmitting wave tube] technology, and we actually moved long ago into solid-state technology,” says Igal Karney, Elta’s manager of marketing and sales. “But still there are so many systems in the field, so the need for TWT has even increased.”

Rumours that IMI, a state-owned munitions company, may be primed for acquisition are emerging in defence circles. Members of the Israeli government occasionally make public statements about partial or total privatisation. Such changes have been floated for years, but Israel’s falling defence budget may finally be the requisite catalyst.

Either way, change of one sort or another is coming to IAI. Its president Yitzhak Nissan, who has held the post for six years, is leaving his position after a semi-public fight with the chairman of the board. Two board members are following. But whether this results in any major changes to business strategy or product road-maps is yet to be seen.

Still, IAI has entered 2012 with a strong outlook. UAV contests in Canada, Germany and Australia could yield quick dividends for the Heron, and a number of smaller, somewhat more opaque contests in smaller nations also offer potential.

By: Zach Rosenberg Tel Aviv Source: Flight International